Practical Information

For ease of use, we have gathered all information with regards to trading at Fish Pool such as trading calendar and terminology.

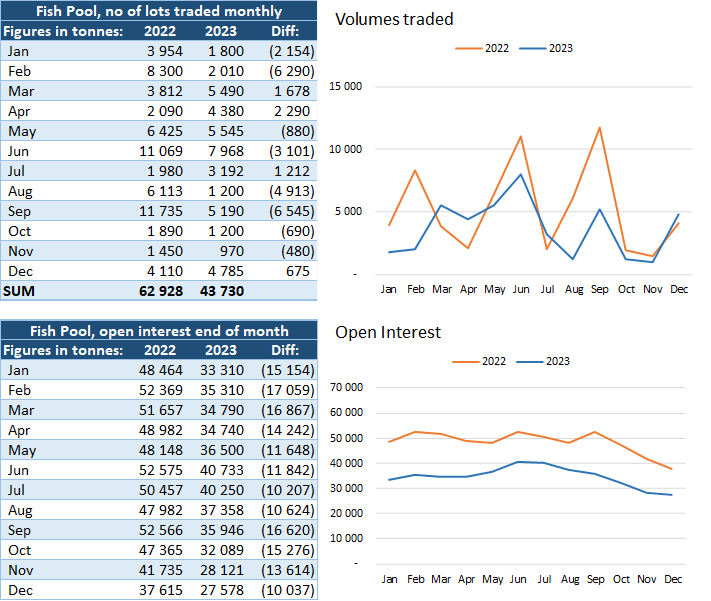

Volumes and Open Interest

Below is the traded volumes and open interest up until the last closed month. The traded months at Fish Pool are officially closed on the second Friday after the last calendar day of the previous month.

Open interest and position limits at Fish Pool

On Dec 31st 2022 the Open interest in salmon futures listed at Fish Pool was 37 615 tons held by end-users. Please note that this Open Interest differs from the Open Interest found on the Nasdaq clearing Website as the Clearinghouse open interest. Nasdaq Clearing nets positions done by Financial institutions trading in their own name. Fish Pool is informed of the end-clients being the owner of the positions traded by a Financial institution at Fish Pool. The Fish Pool open interest calculation is thus based on all open end-user positions done as Direct Members, financial institutions and General Clearing Members. Fish Pool conducts position management control according to the Fish Pool Rulebook chapter 8. Finanstilsynet has set the following position limits for Fish Pool:

- 10 598 tons spot month

- 26 496 tons other months

Please note that (non-financial ie industrial) Fish Pool Trade Members and companies doing financial Fish Pool contracts using a bank, may fill in this Application, and thus be exempted for all Risk-reducing positons (hedges done at Fish Pool). This application is to be used also for non-Norwegian companies, as Finanstilsynet Norway handles this for countries (both inside and outside of the EEA, European Economic Area). Please see Regulatory information on www.fishpool.eu or call us for more information

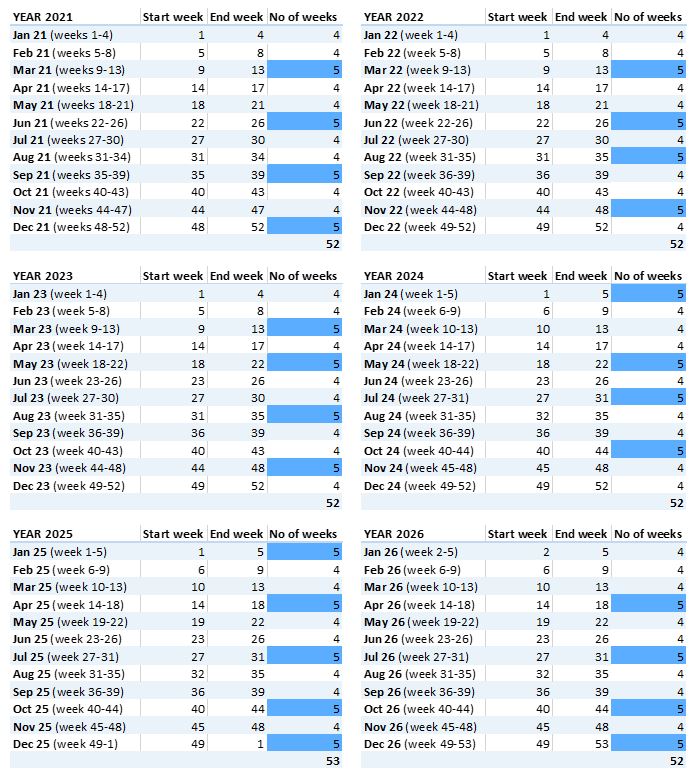

Trading Calendar

All contracts traded at Fish Pool are settled against the monthly spot price (FPI™). As FPI is collected weekly the monthly value must be calculated. A week with days from two different months is defined as a week belonging to the same month as the Wednesday in the week.

Example

March 2021: Week 13 is divided between March and April. March 31st is a Wednesday. Week 13 is therefore included in March.

Terminology

Terms, expressions and abbreviations used when trading financial products are explained below. For explanations in Norwegian, check the Financial Dictionary at Oslo Børs’ homepage here.

All or nothing: A buy or sell trade that instructs the broker that the entire order needs to be filled. For example, if there are 40 tonnes being offered, and you want to buy 50 tonnes, the broker will have to wait until there are 50 tonnes offered to fill the trade.

Ask price: Lowest price any seller is willing to accept per tonne for a given period of time. When a buyer wants to buy a forward/future contract, this is the price he has to pay. Ask price could also be referred to as the offer price or selling price.

At-the-money: A transaction whose price is the same as the prevailing market price of the relevant underlying at the time of trading. An option where the exercise price is equal or very close to the current market price of the underlying – the forward price. This option has no intrinsic value.

Benchmark: A standard against which a fund’s performance, exposures or risk is measured. Benchmarks tend to be indices but can be any collection of securities and weights. To be considered a legitimate benchmark, the collection has to be knowable in advance and transparent

Backwardation: A condition in which the forward/futures price is lower than the current spot price, generally describing a downward sloping forward curve. The opposite of Contango.

Bear Market: A general downward movement in a market over a sustained period of time.

Bid price: Highest price that any buyer is willing to pay per tonne at any given period. This is the price that a seller can sell at. Bid price could also be referred to as give price or buying price.

Bid/Ask spread: The difference between the “bid” and “ask” price. Normally the more liquid the product, the smaller the spread.

Broker: The exchange, or middleman in the transaction between the buyer and the seller of forwards/futures.

Bull Market: A general upward movement in a market over a sustained period of time.

Call Option – Asian: A contract that entitles the holder (buyer) to receive the positive difference between the exercise price and the spot price. Compare with Put option.

Clearing: A Clearing House becomes the counterparty for both the seller and the buyer in a trade. This helps to reduce the market risk for trading firms. When trading Fish Pool forwards/futures and options, clearing service is provided by Nasdaq.

Clearing House: A financial market infrastructure that provides clearing and settlement services and ensures delivery of payments for its members’ transactions.

Closing Price: The market price for the relevant Forward/Future Month assessed daily by Fish Pool officially designated as the “close”.

Contango: A condition in which the forward/futures price is higher than the current spot price, generally describing an upward sloping forward curve. The opposite of “backwardation”.

Counterparty credit risk: In the context of trading noen-cleared contracts (bilateral), there is a risk that a counterparty will fail to meet its obligations due to a deterioration in the counterparty’s creditworthiness.

Derivative: A derivative derives its value from the price or level of an underlying asset or measurement, such as a bond, loan, equity, currency, commodity, index, published interest rate or a combination of the above. At Fish Pool, the value of a forward/future or an option derives its value from the expected average spot price of salmon for the traded period.

European Market Infrastructure Regulation (EMIR): Regulation of the European Parliament and Council on Over-the-Counter (OTC) derivatives, central counterparties and trade repositories. The regulation introduces requirements for OTC derivatives transactions which meet the eligibility criteria to be cleared through central counterparties and all OTC derivatives transactions to be reported to trade repositories.

Exercise Price: The exercise Price in an option (also called strike price) is the price at which the option value in the contract will be set at the time of settlement. The difference between the Exercise price and the spot price defines the value of the Option.

Expiration Date: The day on which an Option is subject to expiry for cash settlement.

Exchange-traded fund (ETF): An index fund which is traded on the stock market.

Fill: The details of the trade that was executed- i.e. quantity and price.

Filled: A trade that has been completely executed- i.e. all tonnes have been bought/sold

Fill or Kill: A buy or sell trade that instructs the broker to either fill the entire order immediately or cancel the trade.

Firm price/order: A binding offer to buy or sell by a Trade Member. A Firm order is tradable without further confirmations

Forward: Financial contract with cash settlement between two named and identified Trade Members with counterparty credit risk. A Forward is not Cleared and is also referred to as a Non-Cleared or bilateral Contract.

Forward price curve: A graph of the forward/future value of a commodity or financial instrument over time.

Forward/Future: Cleared financial contract where a clearinghouse acts as central counterpart in all contracts guaranteeing the settlement. Forwards/futures are subject to daily settlement (mark to market) against the closing price.

Given: A seller “hits” the price which is quoted by the buyer

Good For the Day: Market or Limit order that remains active only until the end of the trading session

Good Till Cancel (GTC): Market or Limit order that remains active until the trade is cancelled or the trade gets filled. This can occur over multiple trading sessions if the order isn’t filled.

Hedging: A trading strategy which is designed to reduce or mitigate risk. A second transaction is entered into to offset the risk of the first. A hedge is used to reduce any substantial losses/gains suffered by an individual or an organisation.

Historical volatility: A measure of price fluctuation over time. It uses historical (daily, weekly, monthly, quarterly and yearly) price data to empirically measure the volatility of a market or instrument in the past.

Implied Volatility: Volatility implied by the market price of the option based on an option pricing model.

In-the-money: A position which has intrinsic value, for example a portfolio acquired at a rate which is more advantageous than current market rates.

Index: A single number calculated from the total value of a basket of prices, example Fish Pool Index.

Index fund: Fund that attempts to closely mirror the performance of an index.

Liquidity: A market with a high level of trading activity.

Limit Order: A buy order that instructs a broker to only buy at or below a specified price, or a sell order that instructs a broker to only sell at or above a specified price. This type of order insures that you never pay more than you intend, or conversely sell for less than you want.

Nasdaq: The National Association of Securities Dealers Automated Quotations, more commonly known as Nasdaq, is an all electronic exchange, which accounts for some of the highest trading volume in the world. Many technology companies choose to list on the Nasdaq.

Margin: The sum of money or value of securities required to be transferred and maintained, in order to provide protection to the recipient of margin against default by a counterparty to a trade. Nasdaq demands margin set as cash.

Mark-to-Market: The process of revaluing the book value or collateral value of a forward/future contract or security on a regular basis to reflect the current market value.

Markets in Financial Instruments Directive (MiFID): Regulatory framework which aims to provide uniform regulations across the European Economic Area (EEA) for the financial and investment services sector. The uniform regulations facilitate the freedom of movement for goods, services and capital across the member countries in exchange for adhering to the European Union laws and policies.

Options: An Asian option at Fish Pool is a contract traded in which the payoff is based on the difference between the exercise price and the monthly settlement price. The writer of an option receives a premium from the buyer (holder).

Option Type: Either a Call (gives payoff at higher spot prices) or a Put (gives payoff at lower spot prices).

Option writer: Party to an Option which is entitled to the Option Premium while under the obligation to pay Option Cash Settlement. Also known as Option Grantor or Option Seller.

Out-of-the-money: A position which has no intrinsic value, for example a call option with a strike price higher than the future price.

Over-the-Counter (OTC) transaction: Financial contracts or other instruments between two counterparties where the terms of such transaction are freely negotiated, as distinct from an exchange-traded transaction where the size, tenor and other terms are prescribed by the rules of the relevant exchange. Also referred to as “off-exchange”.

Partial Fill: A trade that has not been completely executed- i.e. only some of the buys/sells requested volumes were executed in the market.

Portfolio: A collection of open positions (forwards/futures, securities or other assets) held by an investor.

Portfolio margining: A method for setting margin requirements that evaluates positions as a group or portfolio and takes into account the potential for losses on some positions to be offset by gains on others. The margin requirement for a portfolio is typically set equal to an estimate of the largest possible decline in the net value of the portfolio that could occur under assumed changes in market conditions. Sometimes referred to as risk-based margining.

Premium: Price agreed between the option holder and option writer when entering into an option. An option holder shall pay and the option writer shall receive the option premium.

Pre-Market Trading: Electronic trading done before the start of regular market hours

Price spread (also known as bid/ask spread): The difference between the “bid” and “ask” price on a forward/future contract.

Put Option – Asian: A contract that entitles the holder (buyer) to receive the positive difference between the spot price and the exercise price. Compare with Call Option.

Settlement: The process whereby the difference between the contracted price and spot price multiplied with the traded volume for the month is cash settled with buyer and seller.

Spot price: The price quoted for at commodity with immediate delivery, at Fish Pool, the weekly spot price defined as the Fish Pool Index.

Stop-loss-order: An order placed with a broker to buy or sell a particular underlying at the market price, if and when the price reaches a specified level. This type of order limits the investor’s loss against the adverse market moves.

Strike price: The price at which an underlying of an Option contract may be bought or sold. Also called “exercise price”.

Taken: A buyer “hits” the price which is quoted by the seller

Ticker: Abbreviation on exchanges to easily look up securities. For example at Bloombergs, individual tickercodes for Fish Pool forwards/futures are available under tickercode CME FPL: CSOA Comdty – Cleared Salmon Calendar Yearly Futures CSAA Comdty – Cleared Salmon Monthly Futures CSCA Comdty – Cleared Salmon Quarterly Futures CSEA Comdty – Cleared Salmon Semi Annual Futures

Trader: A named representative of a trade member authorised to carry out trading, buying and/or selling, at the exchange or in the market.

Volatility: The risk of future, measured by its daily price movements. In finance, volatility, standard deviation, and risk are all synonymous.

Abbreviations:

TMA – Trade Membership Agreement

TC – Trade Confirmation

YTD – The calendar Year-To-Date return from January 1 to the present.

T – Tonnes = 1 000 kilos

Both “ton” and “tonne” are units of weight, but a “ton” is a British and American measure, while a “tonne” is a metric measure. You should be careful when using the word “ton”, as there are two different types – British and American. The British ton (also used in other countries that have the Imperial system of weights and measures) is equal to 2,240 pounds or 1,016.047 kg. It is sometimes referred to as the “long ton”, “weight ton” or “gross ton”. The North American ton (only used in the United States and Canada) is equal to 2,000 pounds or 907.1847 kg. It is sometimes referred to as the “short ton” or “net ton”.

Salmon contracts at Fish Pool are traded in metric tonnes, T, corresponding to 1 000 kilos.