Predictability in risk exposed fish and seafood markets through cash-settled contracts

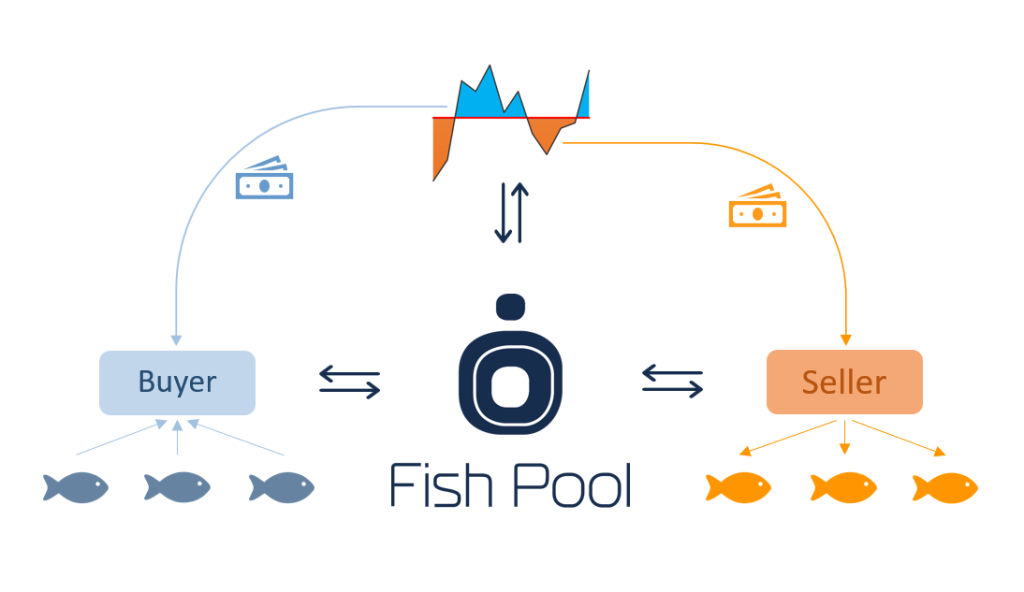

Fish Pool offers an instrument for risk management which can offer a better predictability for the bottom line and at the same time offer the flexibility needed in order to trade an underlying biological product. The prices for Atlantic Salmon are highly volatile and represent a continuous risk for all parties involved.

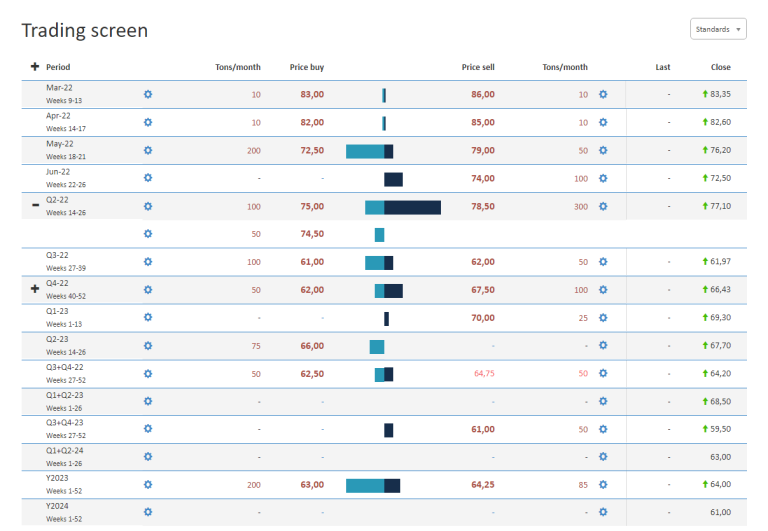

A financial contract works independent of the physical delivery of fish. When the contract has come to the realisation period, the buyer and seller will either receive or pay the difference between the agreed contract price and the last months average spot price, measured as Fish Pool Index™

Fish Pool ASA operates and its team lives by the following core values: Integrity, Dedicated, Competent and Down-to-earth

Fish Pool sends weekly reports to a vast number of people. Follow the link to subscribe to the Fish Pool Price Status, Nasdaq Salmon Index Report and Newsletter.

| Cookie | Duration | Description |

|---|---|---|

| cookielawinfo-checkbox-analytics | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Analytics". |

| cookielawinfo-checkbox-necessary | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookies is used to store the user consent for the cookies in the category "Necessary". |

| viewed_cookie_policy | 11 months | The cookie is set by the GDPR Cookie Consent plugin and is used to store whether or not user has consented to the use of cookies. It does not store any personal data. |