Fish Pool Concept

Fish Pool matches sellers and buyers. The two parties agree on a contract where price, period and volume is specified. How will the contract be settled at Fish Pool? Learn more about Fish Pool concept before you start trading.

Fish Pool Concept

Fish Pool ASA is authorised to operate an international, regulated marketplace for trading of derivatives within fish and seafood. We offer financial salmon contracts – futures.

Watch our presentations or read the text below to get an explanation of Fish Pools products. You are also welcome to call us at +47 55 70 67 00 if you have any questions. If you want information about the physical salmon market, the Mowi Industry Handbook provides a comprehensive insight into the salmon industry.

Download presentations here:

Part 1: Introduction to Fish Pool in English, Norwegian (norsk) or French (Français)

Part 2: Clearing of Fish Pool contracts in English, Norwegian (norsk) or French (Français)

Presenting the Fish Pool concept

The prices for Atlantic Salmon are highly volatile and represent a continuous risk for all parties involved. The lack of predictability makes it difficult for the buyers and sellers to plan their investments and operational activities in a longer time perspective. The industry needs an instrument for risk management which can offer a better predictability for the bottom line and at the same time offer the flexibility needed in order to trade an underlying biological product.

Why are Fish Pools products important?

Financial contracts represent such a tool. A financial contract works independent of the physical delivery of fish. The basis of this concept is that a buyer and a seller – with Fish Pool as intermediate – agree on a price and a fixed volume for a future delivery. When the contract has come to the realisation period, the buyer and seller will either receive or pay the difference between the agreed contract price and the last months average spot price (measured as Fish Pool Index TM).

Fish Pool in brief:

- Two trade members at Fish Pool agree today about a price in NOK/kg and a volume in 1 tonne lots for one or several future months. This is the contract price.

- The contract price reflects the expected future price for fresh, gutted salmon 3-6 kg, Superior Quality, delivered FCA Oslo.

- Fish Pool Index TM reflects the average total monthly market price for fresh, gutted salmon delivered FCA Oslo. This is called the spot price (NOK/kg). Read more about Fish Pool Index™ here.

- If the spot price for the contracted month is higher (lower) than the contract price, the seller (buyer) pays the buyer (seller) the difference between the contract price and the spot price multiplied by the contracted volume in kg.

Illustrative example:

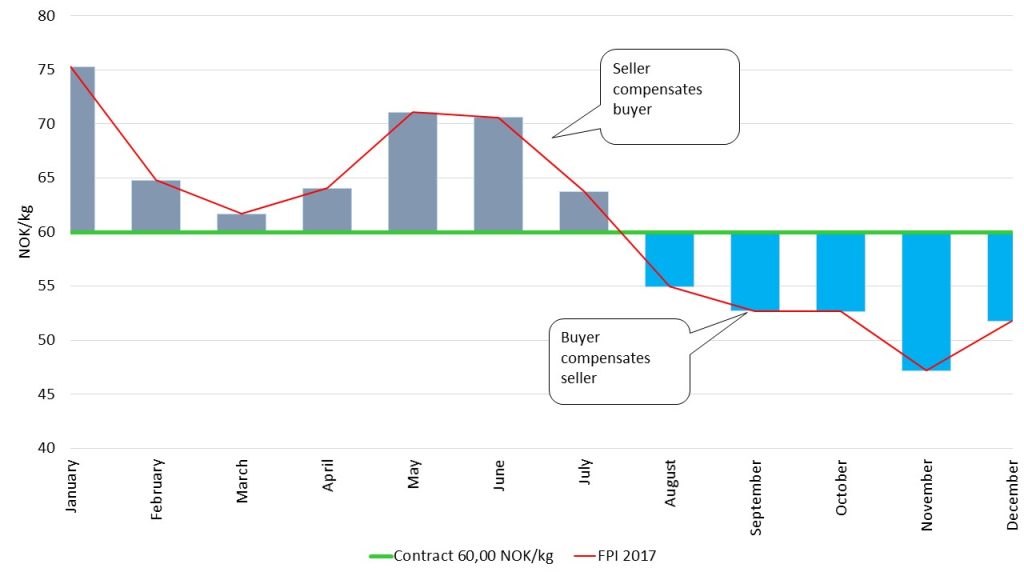

A buyer and a seller agrees on a full year contract for 2017 in October 2016 for a price of 60.00 NOK/kg and for a volume of 100 tonnes a month at Fish Pool. The contract is to be settled as a cleared contract the coming year, with daily mark-to-markets and each month is settled the second Friday the following month.

When January, first month of the year, is done, the following happens:

The average market price (reflected by Fish Pool Index TM) for January turned out to be 75.00 NOK/kg.

- The buyer and seller are settled against Fish Pool Index TM. In our example the difference between the contract price and the index is 60.00 NOK/kg – 75.00 NOK/kg = -15.00 NOK/kg. The buyer receives a payment of 15.00 NOK/kg x 100 t = 1’500’000 NOK, which is to be covered by the seller of the contract.

- Both parties has managed to secure their price at a level of 60.00 NOK/kg at the time of settlement.

- During January, both parties have been able to buy or sell their fish in the physical spot market at a level of approximately 75.00 NOK/kg.

In this example the seller would compensate the buyer until the end of July. When entering August the spot prices (calculated as Fish Pool Index) went below the contract price of 60.00 NOK/kg, and the buyer compensated the seller the rest of the year. For example: when November is done, the following happens:

The average market price (reflected by Fish Pool Index TM) for November turned out to be 47.00 NOK/kg.

- In our example the difference between the contract price and the index is 60.00 NOK/kg – 47.00 NOK/kg = -13.00 NOK/kg. The seller receives a payment of 13.00 NOK/kg x 100 t = 1’300’000 NOK, which is to be covered by the buyer of the contract.

- Both parties has managed to secure their price at a level of 60.00 NOK/kg at the time of settlement.

- During November, both parties have been able to buy or sell their fish in the physical spot market at a level of approximately 47.00 NOK/kg.

What are the advantages of this concept?

In contrast to the traditional physical contracts, well known to the salmon industry, the financial contracts offers the following advantages:

- Opportunities for a more stable and predictable income.

- Long term horizon. Focus on prices up to 2 years ahead.

- Insertion of smolt based on factual price information.

- Ability to make back-to-back fix price agreements.

- Opportunity to secure a price, but still have the full flexibility concerning decisions related to harvesting, processing or trading of fish.

- Easy and flexible to enter and to exit contract positions.

- Trading the next 2 years independently of biomass.